February 2024 - San Diego Real Estate Market Update

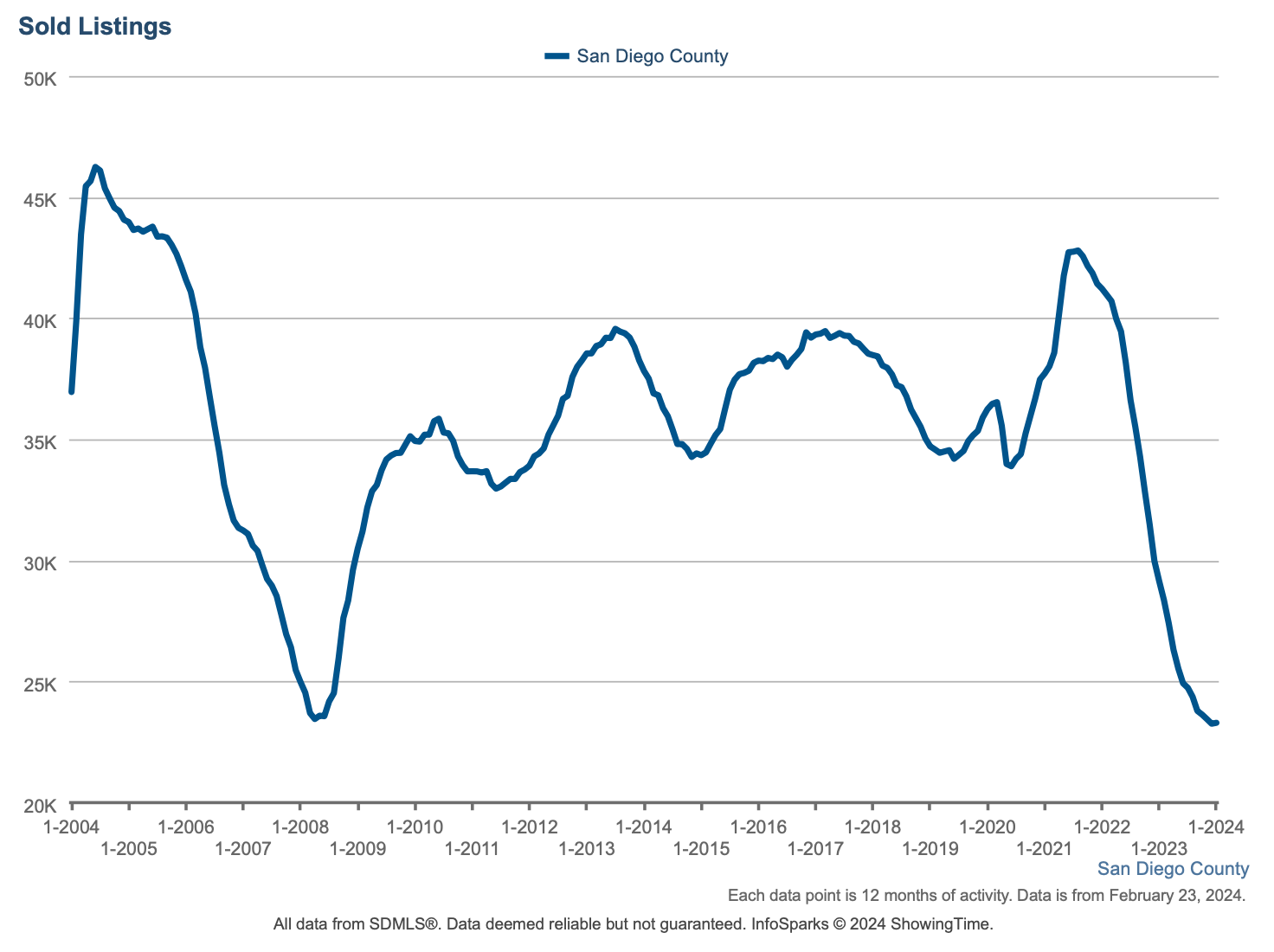

At this moment in time, there is one data metric that is driving the real estate market. Both homebuyer demand and inventory of homes for sale, or seller motivation, hinge almost entirely upon mortgage interest rates. Rock-bottom mortgage interest rates prevailed from 2009, a stimulus effort post-Great Recession, until the Spring of 2022 when inflation peaked at its highest point in 4 decades, and the Fed took action by raising the federal funds rate, with rates peaking in October of last year at over 8%. Today, 90% of homeowners in the US have a mortgage rate below 6% and two-thirds have a mortgage rate below 4%. Rates hovering above that threshold have restricted homeowners from listing their properties, as well as demand from would-be homebuyers, as affordability challenges prevail. As a result, 2023 saw the slowest home sales pace on record.

The Fed raised rates to get a hold on runaway inflation and had a tricky dual mandate to do so without triggering a recession. This is tough to achieve as high employment and wages, as we have seen in the last several years, enable consumers to spend freely, creating high demand for goods and services. Part of the reason inflation spiked was that demand was high while supply was limited due to the impacts of COVID-19, global conflict, and supply chain issues, which caused prices to rise. The room that existed to ease supply issues likely gave the Fed confidence in accomplishing a so-called “soft landing.” Thus far, it seems like they’ve succeeded, as inflation has reduced substantially and the employment market has remained strong.

For this reason, the Fed began to hold rates steady in the latter part of last year and into this year which eased pressure on mortgage rates slightly. Originally, there was market speculation that the Fed would begin cutting rates in March, however stronger-than-expected financial data indicates it may not happen that quickly. While the Fed did indicate they expected to lower rates 3 times in 2024, that is certainly not written in stone, nor is the timeline for them doing so a given. As a result, we’re seeing frequent fluctuations in mortgage rates as they react to the Fed, activity in the financial markets, and homebuyer demand.

So far in 2024, rates have fluctuated between an average of about 6.6% to 7.5%, lower than the peaks in October of last year, but still much higher than homeowners' rates on their current homes. Last year at this time, the question was “how high will rates go.” Today, the questions are: “How long until rates come down;” and, “How low will rates go in the future.” The answers to these questions will determine market outcomes such as listing inventory, buyer demand, and home prices. Most likely, we will see market peaks and valleys throughout the year as rates behave with some volatility, influenced by the upcoming election, financial data, and housing market shifts.

As mortgage rates have eased somewhat, we have seen a bit of an uptick in listing inventory. Some of this is seasonal, November into December and January are always slower months for home sales and listings, but this year was especially tight as inventory and monthly new listings were already so much lower than average before the seasonal draught for all of the reasons discussed, as well as chronic underbuilding locally. Typically, January listing activity sees inventory levels return to that of the previous Fall. This January, we saw inventory levels return to that of last Summer - the high season. That’s a beacon of hope for what is to come this year, but not a guarantee. The portion of the spike that cannot be accounted for by seasonality is a result of mortgage rates decreasing. We will need to see that trend continue to see increased listing activity hold strong.

Based on the number of homes that went pending in January, coupled with the increased number of showings per listing that we’re seeing currently, it seems homebuyer demand is also edging upward, but not a breakneck speed. About half of the available listings for sale went under contract in January, and for just under the list price on average. This is great, as it keeps home price growth stable rather than explosive, and the market likes predictability.

When demand is outpacing supply, we see all of the new listings and some of the previously existing inventory snapped up quickly, which causes prices to skyrocket. If rates drop quickly, we will likely see demand explode and prices follow, erasing any progress rates may have created in easing affordability concerns. Affordability is the primary challenge the real estate industry faces today, and while we want home prices to grow, a slow but steady climb is better for homebuyers and homeowners alike. As home prices were a major contributor to runaway inflation in the first place, the Fed will likely try to control rates moving slowly so as not to cause demand to spike all at once.

Median home values are lower now than their 2023 highs, however year-over-year, the median home value rose just under 10% in total, and nearly 40% since January 2020. That represents huge equity (a.k.a. wealth) gains for homeowners. The problem for homeowners is that at the current rates, even with their equity, they couldn’t afford the mortgage on their current homes, let alone on more expensive ones. As for empty nesters who tend to move down, the research says that not only do they not want to pay the same monthly payment for a home half the size of their current home, but they also love their larger homes and don’t care to move. As a result, this demographic owns nearly 30% of larger homes, while younger people with kids own only 14%. Between the low turnover rate (12%, nearly double that of two decades ago) and the chronic underbuilding across the country, and especially in Southern California, inventory is primed to remain low, causing prices to remain on an upward trajectory.

There is a bright spot in these market dynamics, and that is that, while the housing market faces other challenges, the risk of a housing crash is not one of them. The risk of a housing crash is extremely low, as homeowners retain high levels of equity to pad any potential shortfalls, and today’s mortgage holders are amongst the most well-qualified at any point in history. To see a crash, we would need a huge glut of supply without adequate demand to absorb it, a combination of factors that seems unlikely in the near future by all accounts.

We did see an uptick in foreclosure filings in January, however even with the increase, we still see foreclosures well below the rate they held in 2019, which was low then by historical standards. Furthermore, a very small number of foreclosure starts make it to auction or repossession as most homeowners can cure their default in payments before the foreclosure actions progress.

Although the market certainly faces headwinds like inflation, job layoffs, high interest rates, and global unrest; there are also many signs of an improving economy and improvements in the housing market for both buyers and sellers, alike. The political pressure for economic improvements this year is huge, so let’s hope that works in all of our favor.

Most importantly, if you have questions or concerns about your specific situation… CALL ME to help sort through them. That’s why we get up in the morning - not just to sell homes, but to serve our clients.

As always, we will be here to continue to provide you with updates about the housing market and answer any and all of your questions. Feel free to reach out to us anytime.

HOMEOWNER RESOURCES:

FUTURE HOME BUYER RESOURCES:

Say Hello

Get in Touch With Us

301 Santa Fe Drive Ste B, Encinitas, CA, 92024