March 2024 - San Diego Real Estate Market Update

As the U.S. continues to add more jobs each month than expected and inflation continues to run too hot for the Fed, we are seeing interest rates remain higher for longer than expected around the end of 2023. The Fed is expected to hold interest rates at their current levels until they are confident they are nearing their 2% target. As such, we have seen some slight fluctuations in mortgage interest rates, but they remain high enough that they are depressing home listing and sales activity.

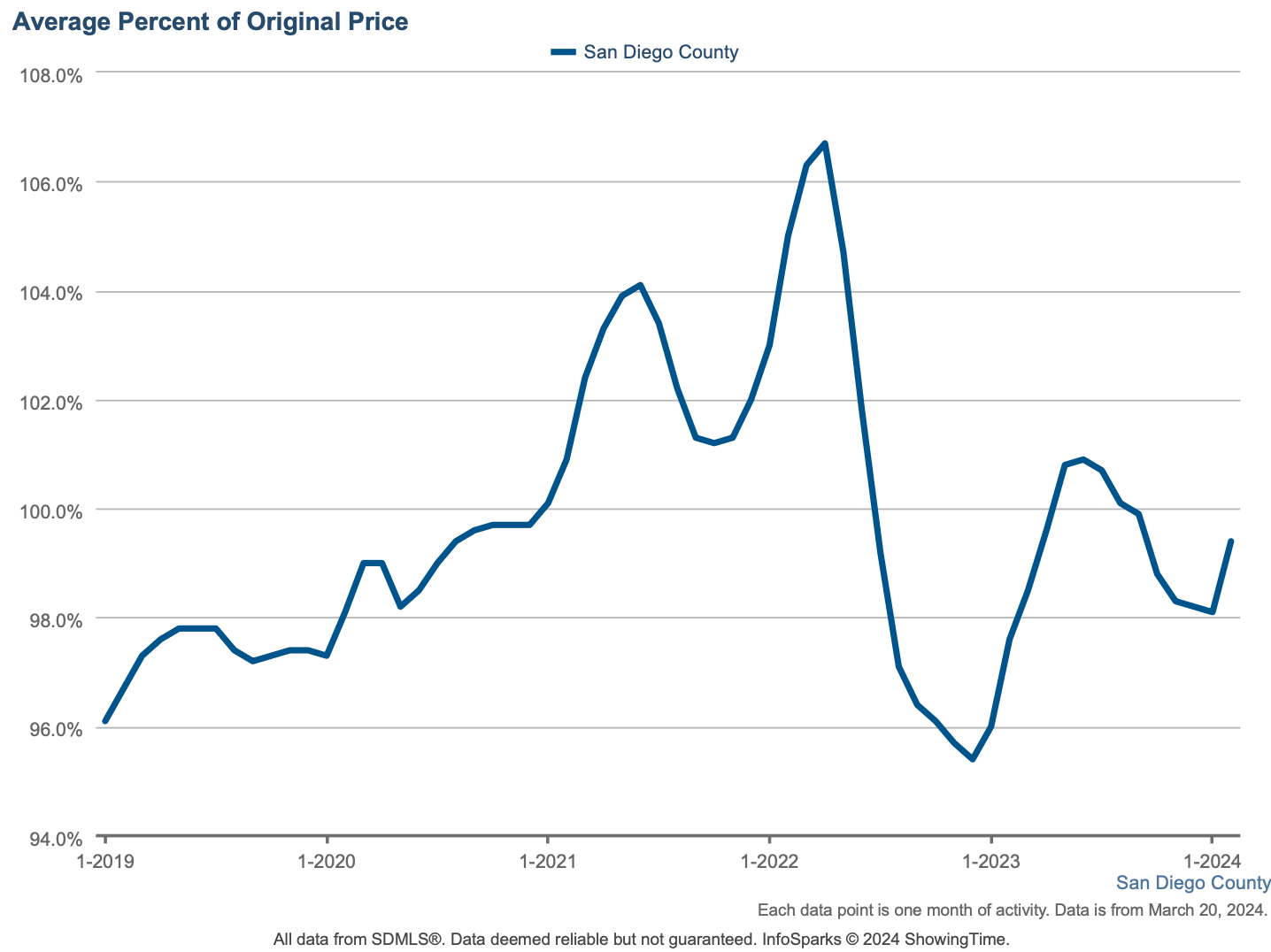

Pending and sold listings are both up month-over-month and selling for at or near list price in under a month on average in February. Home sales are still slower than they’ve been at any period besides late 2007/early 2008 and late 2022/early 2023. We are, however, expecting to see more activity in 2024 than we did last year when the fewest homes had sold in a single year since the mid-1990s. This is in part because consumers trust that rates will be headed downward in the coming months and years which will present an opportunity to refinance, while home prices are expected to continue their upward trajectory which will allow for equity growth and present long-term savings compared to waiting to purchase a home when rates are lower but prices have risen further.

Currently, the single-family detached home median sales price in San Diego is at an all-time high of $1,029,000 which represents a gain of 14.5% year-over-year and a staggering 6% month-over-month–the highest rate of any city in the nation. The median price for attached homes has not yet surpassed all-time highs from May of 2022 of $970,000, but they’re close at $955,000. This is likely due to the challenge that HOA fees present in qualifying for home loans - a potential buyer can qualify to spend more on a single-family home than on an attached home, and the median prices on the two home types aren’t very far apart, so for this reason and others, demand is higher for single-family homes.

Inventory of homes for sale remains historically low in a trend that began before the pandemic in 2019 and has been worsened by pandemic-related headwinds and more recently, high mortgage interest rates. Inventory remained relatively flat throughout all of 2023 and into this year despite peaks and valleys in the number of new listings that have hit the market, which is mostly seasonally driven but also reacts to mortgage rate fluctuations. December of 2023 saw the fewest new listings of any month on record. While the month-over-month new listing count improved substantially in January, February saw fewer new listings than the previous month. The spring and summer should bring higher new listing counts and increased sales activity. Then, we should expect a substantial slowdown in the fall due to normal seasonal trends as well as in response to the presidential election.

Most importantly, if you have questions or concerns about your specific situation… CALL ME to help sort through them. That’s why we get up in the morning - not just to sell homes, but to serve our clients.

As always, we will be here to continue to provide you with updates about the housing market and answer any and all of your questions. Feel free to reach out to us anytime.

HOMEOWNER RESOURCES:

FUTURE HOME BUYER RESOURCES:

Say Hello

Get in Touch With Us

301 Santa Fe Drive Ste B, Encinitas, CA, 92024