January 2024 - San Diego Real Estate Market Update

Navigating the landscape of the 2024 real estate market will require careful analysis, as we are seeing a shift away from the trends that drove the last two years into a new trajectory. In the aftermath of the 2023 surge, mortgage interest rates are gradually receding from the previous highs of 8%, bringing homebuyers and sellers off the fence. This will create a delicate equilibrium between buyer demand and the housing inventory which is expected to increase from the current floor but remain historically low. This exploration delves into the nuances of the evolving real estate dynamics, examining the implications for buyers and sellers, as well as the potential impact of an election year on the market's trajectory.

Interest Rates:

In 2024, the real estate market is beginning to see a shift downward in mortgage interest rates. After reaching two-decade highs of over 8% in the latter half of 2023, rates are now declining and are currently hovering around 6.5%. The expectation is for rates to continue dropping as the Federal Reserve lowers the Fed Funds as inflation is regarded as being under control. However, this process may not happen as quickly as anticipated, given a slight uptick in inflation in December. It is projected that rates will remain in the 6% range this year, with a further decrease in 2025, eventually stabilizing around 5%.

Impact of Falling Interest Rates:

The high interest rates in the previous year and a half dampened demand for real estate. As rates decrease, demand will return, a process that we’re already seeing begin to unfold and which has led to a 22% increase in mortgage applications year-over-year in December with another 3% increase month-over-month from December to January. Homeowners, now realizing that rates in the 3-4% range may not return, are more willing to list their homes while buyers dip their toes back into the market. Despite the potential for increased inventory, the chronic issue of low housing supply in southern California persists. With the resurgence of demand, bidding wars are expected to resume, putting upward pressure on home prices.

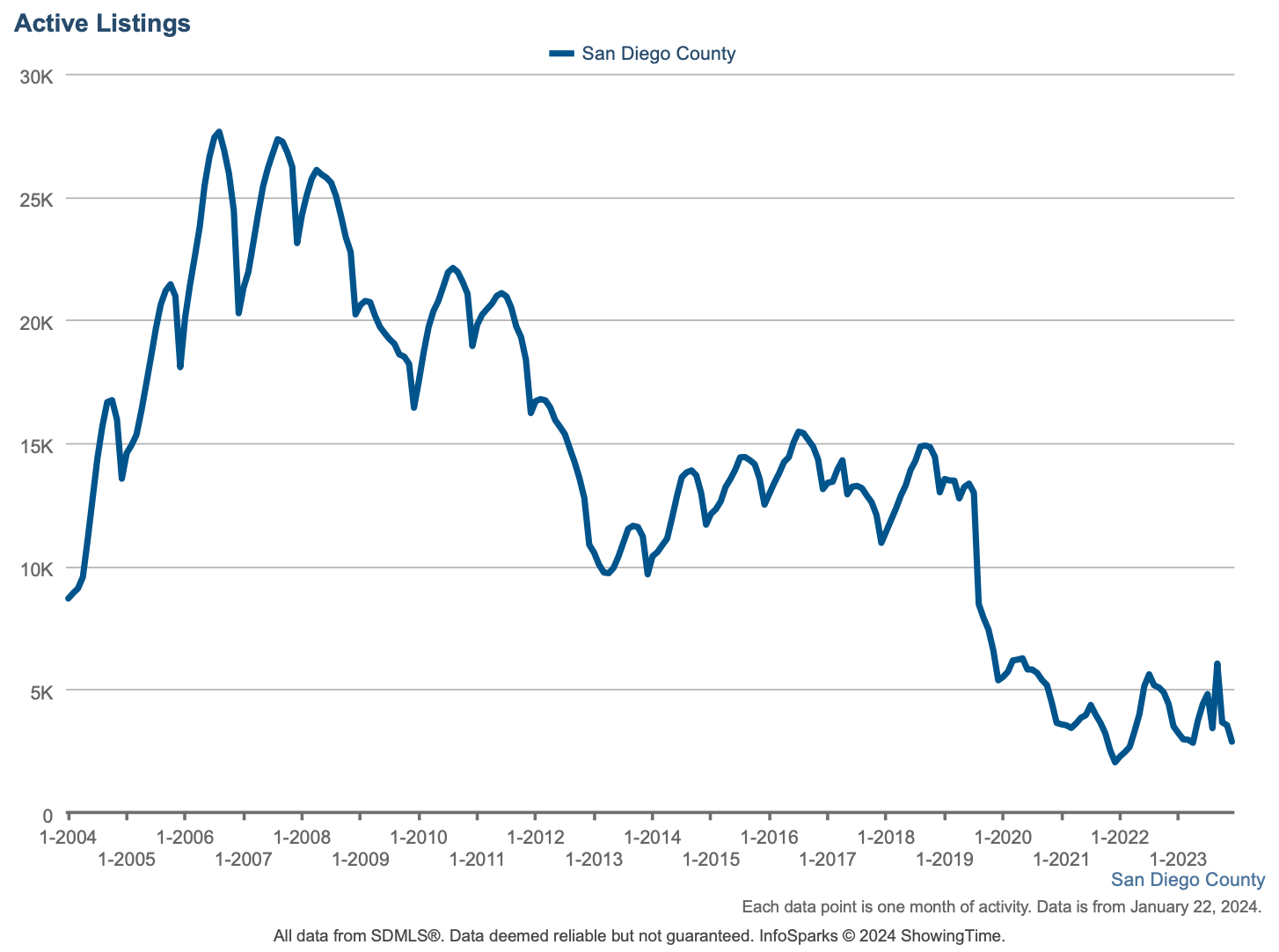

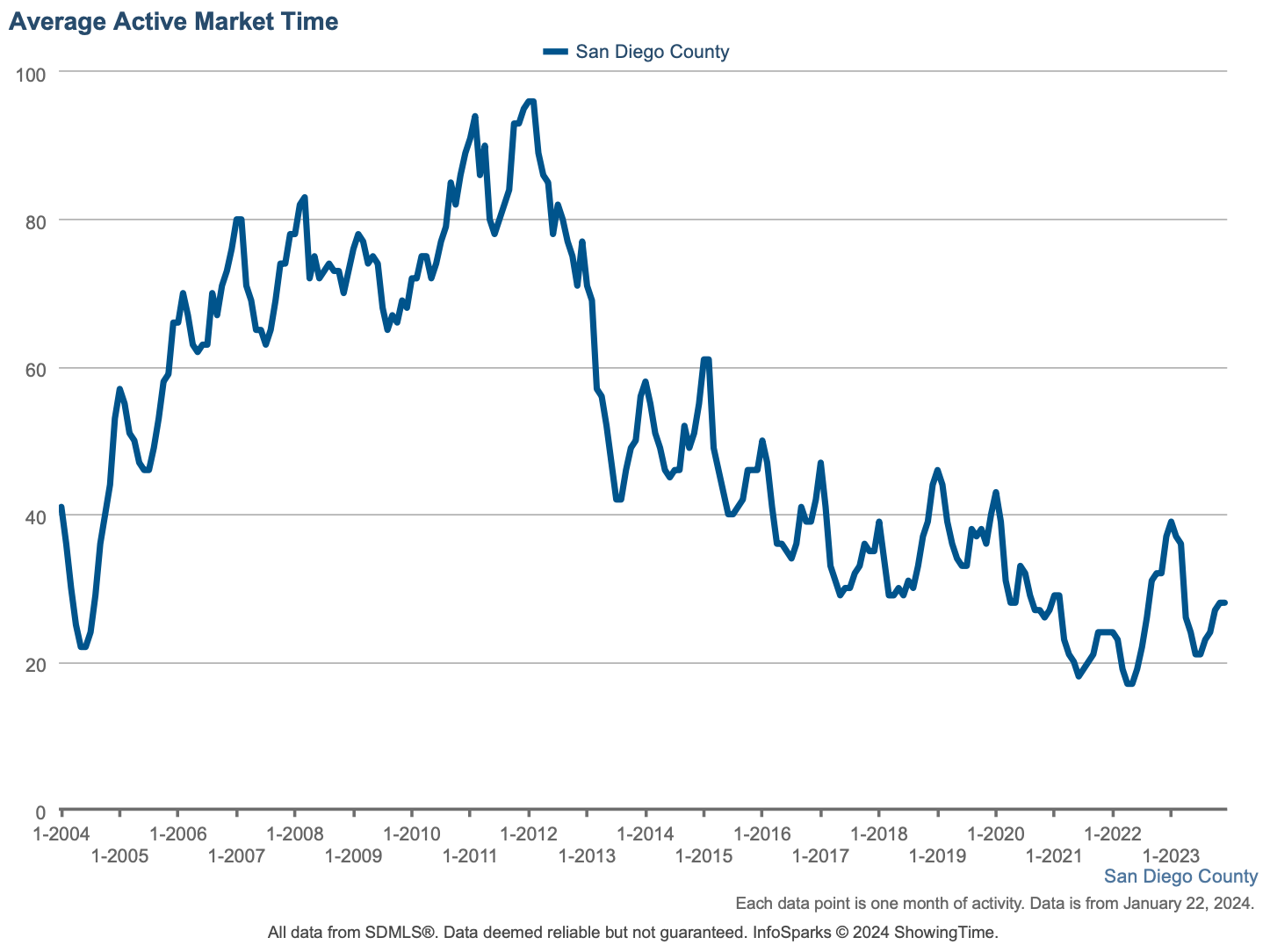

Current Inventory Levels:

The real estate market has faced record-low inventory levels since 2020. In fact, fewer homes sold in 2023 than in any year since 1995, including the 2008 housing market crash due to a combination of low inventory and decreased demand due to higher mortgage rates. The concept of a "balanced market" with 5-7 months of inventory is distant, as inventory levels fluctuate but remain firmly in seller’s market territory. December saw a drop in active inventory, potentially indicating a temporary withdrawal of unsold homes during the holidays. Anticipated new listings in spring may lead to a resurgence of bidding wars and rising home prices as demand rises in kind with supply.

Getting the Most Money for Your Home:

For sellers in 2024, presenting a home in its best light is crucial. While homeowners have amassed incredible equity over the last 4 years, affordability concerns and higher interest rates have strained buyers. That means that most buyers are only interested in move-in-ready homes. Location also plays a significant role, with homes in less desirable areas taking longer to sell. To maximize profits, sellers should focus on making necessary repairs, modernizing aesthetic features, and highlighting unique strengths. Collaborating with an agent with a robust marketing plan is essential for optimal results.

Buying Now vs. Waiting:

The advice "It is better to buy and wait than to wait and buy" holds weight in the current market. Although home prices may seem high, the projected rise in demand due to decreasing interest rates suggests that delaying a home purchase may result in higher costs. You can always refinance your mortgage if rates decrease, but you can’t change the purchase price of your home.

Buyers are presented with a unique opportunity in 2024 as interest rates begin to decrease. The current market offers potential savings vs. where prices are headed, and as such, more buyers are expected to enter as we move into the spring and summer selling season. While waiting for even lower rates is an option, the opportunity to secure a property at a discount, especially for homes needing work or in less in-demand areas, may outweigh the benefits of further rate reductions. Homes are still selling quickly and for near or over the asking price, but competition isn't as high as it will be in the coming months. If you are buying with the ability and intent to stay put for 7-10 years, now is a great time to buy.

Possibility of Recession:

The likelihood of a recession in 2024 is uncertain, with analysts predicting a 45% chance. Despite some economic headwinds, the strong performance of the U.S. economy, coupled with political pressures to avoid a recession during an election year, suggests a potential for mild and short-lived economic downturn, if any.

Real Estate in an Election Year:

Election years typically witness fewer real estate transactions, but 2024 may differ due to the low sales volume in the previous year and falling interest rates. Buyers and sellers may exhibit heightened nervousness and emotion in transactions, influencing decision-making. Regardless of political shifts, real estate tends to rise in value over the long term, emphasizing the importance of individual circumstances in deciding when to buy or sell.

Housing Crash Concerns:

Unlike the conditions leading to the 2008 housing crash, the current market dynamics are different. Predatory lending practices have been curbed, and homeowners now hold well-qualified mortgages. Low unemployment, record levels of equity, and manageable mortgages support to a low risk of excess supply flooding the market. Foreclosures are still below the lows of 2019 for these reasons. The likelihood of a housing crash in the near future is near zero.

The real estate market in 2024 is marked by shifting interest rates, returning demand, and low inventory. Because most home sellers are also home buyers and first-time buyers make up 30-40% of home sales, there is no solution in sight to the low inventory problem that continues to cause home values to rise. Southern California simply doesn’t have enough land in its most desirable areas to build housing adequate for our population. The bad news is that this means affordability is going to continue to be strained. The good news is that for those who own a home or are able to buy one, the equity potential is extremely promising over the short and long term.

2024 is set to be the year that the market accepts the new normal of mortgage rates, gets on with life, and stops putting moving on hold - buying if the time is right and selling if they must.

Most importantly, if you have questions or concerns about your specific situation… CALL ME to help sort through them. That’s why we get up in the morning - not just to sell homes, but to serve our clients.

As always, we will be here to continue to provide you with updates about the housing market and answer any and all of your questions. Feel free to reach out to us anytime.

HOMEOWNER RESOURCES:

FUTURE HOME BUYER RESOURCES:

Say Hello

Get in Touch With Us

301 Santa Fe Drive Ste B, Encinitas, CA, 92024