September 2022 - San Diego Real Estate Market Update

Understanding the real estate market and what exactly is going on is vital in order to see and capitalize on the opportunities that present themselves. We have discussed the massive shift in real estate over the last couple of months where the Pandemic Housing Boom peaked in May of 2022. This shift was driven by the Fed’s need to counteract inflation by raising interest rates - a move meant to suppress consumer spending.

We have seen month-over-month home price declines - both in terms of actual home equity and in terms of the median home sales price. The San Diego median home value has dropped by 8.8% to $780,000 from its high of $855,000 in May of this year. These numbers are creating quite a stir and much speculation of a housing crash, however, it is vital to compare these numbers to last year to fully understand what this means.

When comparing to last year, we still have good news for homeowners, because home values are actually still up by 7.6% to last year's median home value of $725,000. Home prices are up 20.8% to August 2020 with median home values of $645,500, and up a whopping 34.2% since August of 2019 where median home values were $581,000.

There is much speculation with regards to how far home prices will drop, with the most bearish and controversial market analysts predicting a worst case scenario of 15% home price declines nationwide through 2024. That would put the average home value at $727,000, which would take us back to the average home values we saw in April of 2021. We prefer not to speculate and will report the numbers as they actualize because we are starting to see a very interesting CHANGE in buyer demand this last month.

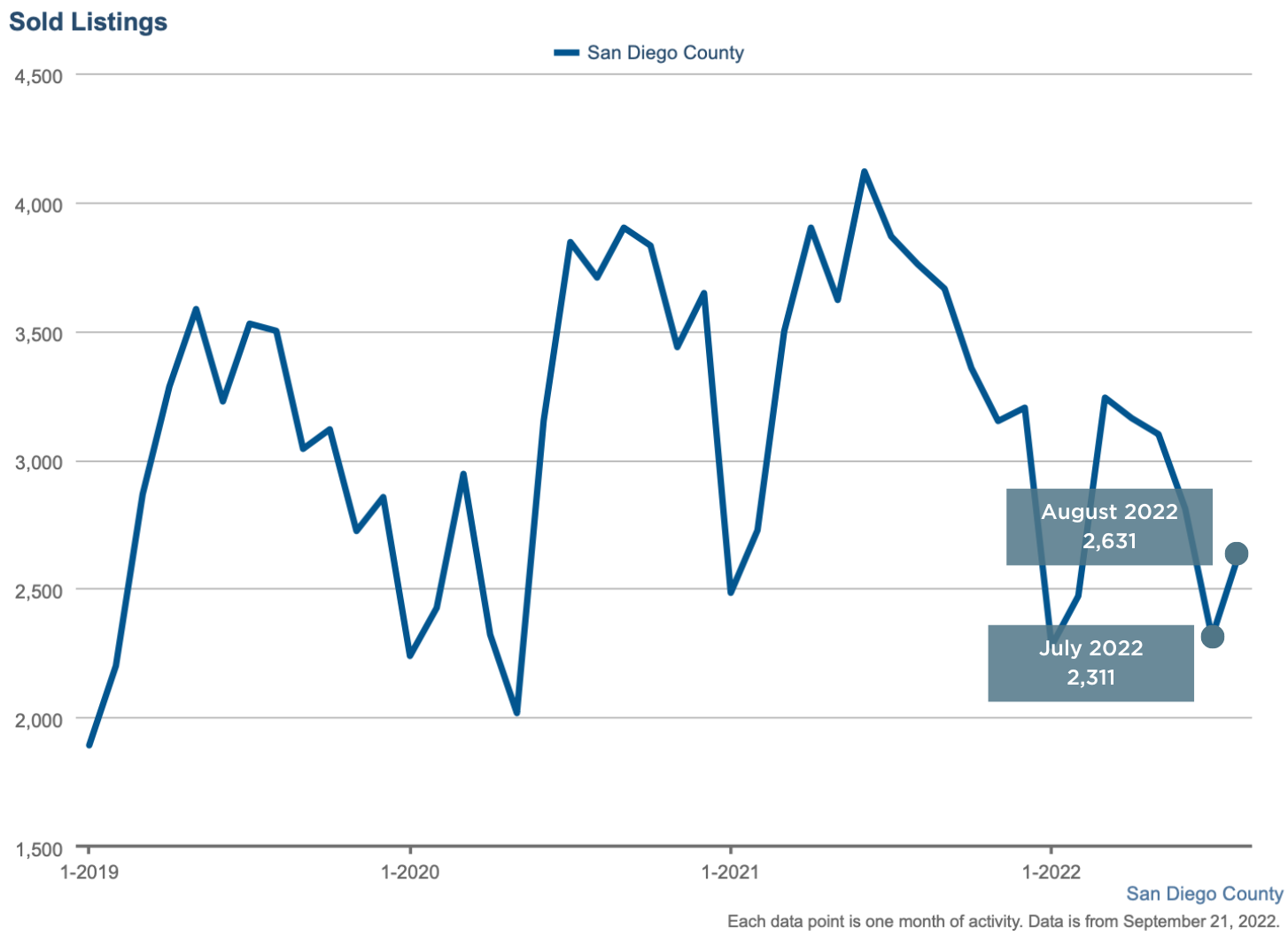

For the first time since March 2022, we have seen an increase in the number of homes sold. We saw 2,600 homes sold in August of 2022, which is an increase of 13.3% to the prior month of 2,300.

A similar trend can be seen in pending homes sales where we have seen almost 2,700 homes go under contract, which is up 10% to last month's 2,400 homes. Buyers are back after a little summer vacation and looking to capitalize on the lower price points and more selection.

So what does this mean for you?

If you’re a hopeful home buyer:

If you’re looking to purchase a home, the game has changed substantially in the last few months. The market looks much less competitive with a substantial decrease in bidding wars and sellers growing more motivated to negotiate as homes sit on the market a bit longer. Overpriced homes have been taking price reductions and often times sell for slightly below their asking price, but well priced, desirable homes are still seeing multiple offers at or slightly above the list price.

The real opportunity right now is getting creative on financing as mortgage interest rates are higher now than they have been in many years. Be sure to shop around for rates other than the 30-year fixed mortgages, as many lenders are competing for borrowers’ business by offering a variety of programs with below-market introductory or even fixed rates. With additional rate increases that the Fed may need to take to address the ever rising inflation, the cost of buying a home will rise from a monthly mortgage payment standpoint. Below is a scenario comparing the actual median sale prices and actual mortgage rates assuming a 20% down payment.

30 Year Fixed30 Year Fixed5/5 ARM May 2022August 2022August 2022Home Price $ 855,000 $ 780,000 $ 780,000Rate4.75%6.63%3.25%Monthly Payment $ 3,568 $ 3,996 $ 2,716Property Taxes $ 730 $ 666 $ 666Total Monthly Payment $ 4,298 $ 4,662 $ 3,382

We have clients who have purchased properties using a 5/5 ARM (some don't plan on owning their home for more than 5 years, while others plan on refinancing once rates come down). This means for the first 5 years the interest rate is locked in at a rate far below the 30-year fixed mortgage, in this scenario it is at a rate of 3.25% vs. the 30 year fixed at 6.63%. By being creative with the financing they have the opportunity to save $77,000 in interest over the next 5 years.

Shop around for the rate, and know that with the still very low inventory of homes for sale and very few new homes coming to market, we are once again trending back into the scenario we saw earlier this year with very little to no inventory. When you see a home that you love, it’s still important to move quickly, as you will have less to choose from in the coming months.

If you’re a potential home seller:

If you’re thinking of moving, it’s important to understand that your expectations may need adjusting from even just two months ago. If comparable homes have recently sold in your neighborhood, expect that your home will sell for a bit less than they did. The worst thing you can do is price your home too high and scare off potential buyers, then do a price reduction which raises a red flag for home shoppers even once you've hit the correct market price.

We are still seeing multiple offers on properties so if you price your home correctly and present it in its very best light, buyers will bid the price up as high as the market can bear. And be patient, homes are sitting on market longer as buyers are not rushing frantically with multiple offers on multiple properties. About half of the homes listed currently will go under contract in under 19 days - but those that have a niche audience or are priced too high will take longer to sell. So be strategic and set yourself up for success in this real estate market.

If you’re a homeowner and not planning to move:

When you see your home value begin to decline, don’t panic. We are not headed for a crash. It is unlikely you will find yourself underwater on your loan as a result of this market correction. Speaking of your loan, pat yourself on the back for securing a great interest rate on your mortgage - rates are likely going to continue to rise and stay on the higher side for the foreseeable future. Remember that you are paying less monthly for your home than someone who moves into a similar home next door with a lower purchase price than yours. When in doubt, remember the old adage - “It is better to buy a home and wait than to wait to buy a home.” On a long enough timeline, your home will prove to be a source of wealth, if it hasn’t already.

As always, we will be here to continue to provide you with updates about the housing market and answer any and all of your questions. Feel free to reach out to us anytime.

HOMEOWNER RESOURCES:

FUTURE HOME BUYER RESOURCES:

Say Hello

Get in Touch With Us

301 Santa Fe Drive Ste B, Encinitas, CA, 92024