July 2023 - San Diego Real Estate Market Update

Despite facing numerous challenges, the housing market witnessed a steady increase in home prices since January of this year. This price growth has occurred without a corresponding decrease in mortgage interest rates. Mortgage rates began climbing as a result of the Fed’s campaign to reduce 40-year high inflation by incrementally raising interest rates, an effort that began in the Spring of 2022. This Fed policy precipitated a significant drop in home values during the period of rate increases from April/May 2022 to December 2022, which was the most drastic decline since the Great Recession. However, prices have rebounded swiftly, indicating that demand continues to outpace supply.

Home values have risen steadily since the housing market began it's recovery from the Great Recession in early 2009. While we have seen mild corrections since then, we had not seen a significant price drop-off until the Federal Reserve began to raise rates last Spring.

The persistent demand can be attributed to a robust labor market with low unemployment rates and workers earning more than they did before the pandemic. Nevertheless, the reduced affordability has led to a more measured approach among buyers. Although many homes still receive multiple offers, bidding wars that inflate home prices by huge percentages have become less common. Referring to strong demand can be misleading, however. The buyer pool has actually shrunk, but due to the near-record low inventory, market dynamics are similar to our previous market, albeit on a smaller scale. Consequently, the current housing market is experiencing the lowest sales volume on record. The decrease in sales volume aligns with the decrease in inventory, indicating that most listed homes do sell, albeit sometimes on longer timelines that we’ve become accustomed to, and generally sell slightly above their list price.

While the true bottom of sales activity occurred this past December and January, on a seasonally adjusted basis, 2023 has seen the lowest sales volume on record.

The drop in prices from Spring of '22 through January of this year was in part caused by lower buyer demand - buyers were no longer willing to pay asking price for homes as interests rates rose, as shown in this graph. Prices adjusted downward and buyer demand began to return, and now homebuyers are paying about 1% over the list price on average.

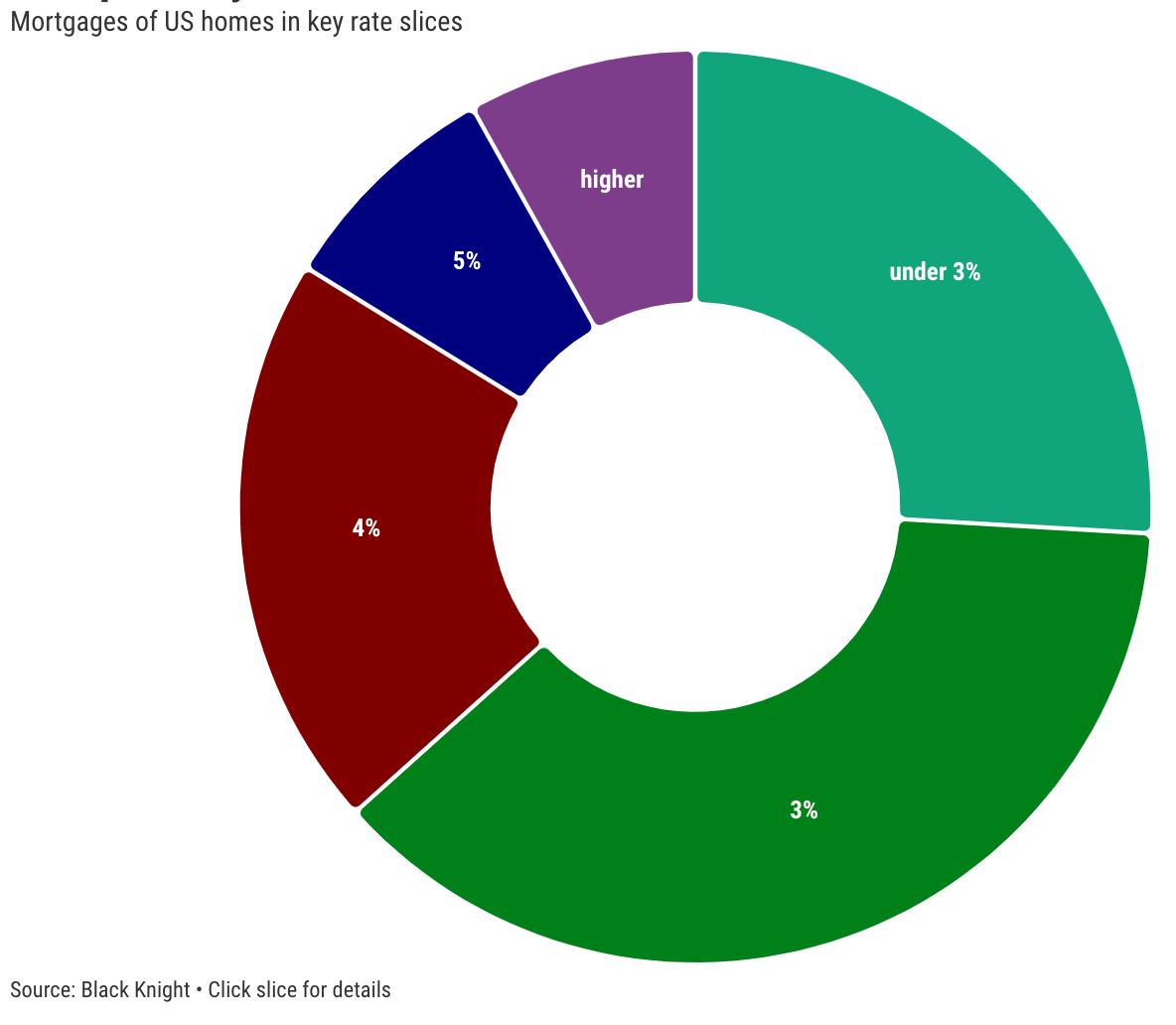

The low inventory can be attributed to the fact that 84% of homeowners in the US have mortgage rates below 5%. Homeowners are hesitant to give up their low monthly payments, which were secured when they purchased their homes at lower prices and with lower rates or had since refinanced to obtain more favorable rates.

While 84% of homeowners have interest rates below 5%, the majority of those homeowners have rates even lower - in the 3% range or less. This makes the prospect of purchasing a new home with an interest rate that is twice as high a tough pill to swallow.

Let's consider a scenario to understand the challenges homeowners face:

Suppose a couple bought their first home, a median-priced property, for$589,000 with a 20% down payment and a 3.5% interest rate mortgage. Their current mortgage payment is $2,900per month.

As their home has appreciated and is now worth $840,000, they now have $369,000 in equity.

If they were to sell, they would incur approximately 8% of their home's value in closing costs and realtor commissions, leaving them with $302,000 to put toward a new home. This amount needs to cover their down payment and closing costs, which typically amount to around 3% of the purchase price.

Considering today's 7% interest rates, even with $302,000 available, they would not be able to buy a home worth $650,000 (which is significantly less than the value of their current home) and maintain the same mortgage payment.

Let's assume they have received raises and saved money during the pandemic, and they are willing to double their mortgage payment to $5,800 per month. With this higher payment, they could potentially spend up to $950,000.

However, the additional $110,000 would only buy them about 182 extra square feet based on the average price per square foot, equivalent to an additional bedroom and bathroom. Considering the substantial increase in mortgage payment, it is unlikely to be worth it for them.

Instead, they explore the option of adding onto their current home, discovering that they can borrow against their equity using a HELOC. They are offered a 9% interest rate on a HELOC and could borrow $100,000, the approximate cost of adding a bedroom and bathroom to their existing home, with an additional payment of just $800 per month.

In all likelihood, these homeowners would choose to stay in their current home.

This graph demonstrates the high average price per square foot that makes moving up to a larger home difficult for many homeowners.

According to mortgage tech and data provider Black Knight, it would take a 30% drop in home prices or a scenario where prices remain constant while rates fall to 5% and a 19% growth in income occurred in order for affordability to return to normal.

With such figures in mind, it becomes evident that the inventory we do see come to market is a result of homeowners who either must sell or individuals relocating to less expensive locales. The local buyers who do purchase the listed homes are often less affected by, or have been forced to accept interest rates and can take advantage of the slight decline in bidding wars and price appreciation that characterized the previous market. Cash buyers, retirees downsizing from larger residences and utilizing equity, individuals with disposable income from more expensive areas, those in need of more space or better school districts willing to pay the price, and even first-time homebuyers facing rising rents are among the buyers in the current local market.

The number of new listings bottomed out in December of 2022 but on a seasonally adjusted basis, inventory is still at an all time low.

Active listings are rising because the most desirable homes sell quickly while other homes sit on the market a bit longer, but the data reflects that most homes that are listed do sell, it may just take a bit longer than we've become accustomed to.

Many other determined homebuyers from Southern California are opting for new builds in states like Texas and Arizona. Builder confidence is high, leading to a significant increase in new home construction aimed at meeting the unmet demand resulting from the low-inventory resale home market. However, in places like Southern California, where land availability is scarce, there are limited options for new construction. Most of the new home construction is happening in states with lower population density and more favorable tax rates, which translates to lower prices. For buyers with substantial assets or income that is not tied to their location, the solution to affordability challenges is clear: move to a less expensive area where their money can go further. In a normal market, newly constructed homes are typically 20% more expensive than resale homes. However, today, new homes are only slightly pricier than equivalent resale homes because hesitant homeowners need to sell at higher prices to make their move financially viable. Additionally, new home sales often come with incentives such as rate buydowns, and new homes generally require less post-closing work compared to resale homes, making them an attractive option.

While the buoyancy of the housing market brings some positive news, there is a downside: the more the housing market defies expectations and remains strong, the greater the likelihood that the Federal Reserve will continue to raise rates. The risk of continuous rate hikes lies in the restriction of consumer spending which is required to reduce inflation, but could also trigger a recession - it’s a delicate balance. The Fed has expressed confidence in achieving a "soft landing" and has successfully reduced inflation without causing a recession thus far. However, the sub-2% target for inflation has yet to be reached, and as rates need to rise further, the risk of a recession becomes greater.

Recession warning signs have been evident for some time, with indicators such as the inverted yield curve, decreased consumer confidence, and bank failures. Yet, the post-pandemic world introduced new dynamics that previous economic models did not account for, such as massive layoffs followed by unprecedented hiring, the conflict in Ukraine, substantial economic stimulus measures, and disruptions in the supply chain. If the US manages to avoid a recession by the end of the year, it would indicate that previous recession prediction models have failed. This raises the question of how the media headlines and consumer opinions will react to such an outcome. It is worth noting that U.S. Treasury Secretary Janet Yellen does not anticipate a recession and has stated, "For the United States, growth has slowed, but our labor market continues to be quite strong. I don't expect a recession. The most recent inflation data were quite encouraging."

However, it's important to note that a recession does not necessarily imply a crash in home prices. During the last recession, people lost their jobs, interest rates soared, and the prevalence of adjustable-rate mortgages led to many homeowners facing unaffordable mortgage payments and were forced to sell. In the previous years their homes had gained substantial equity which was quickly gutted as inventory soared and homebuyer demand plummeted. As a result, a wave of short sales and foreclosures flooded the market, causing home prices to plummet further. The current conditions are vastly different. Most homeowners have substantial equity and fixed-rate mortgages, enabling them to continue making their payments, or sell at a profit. The risk of short sales or foreclosures is therefore minimal. The factors causing homebuyer demand to decline are the same factors causing housing inventory to decline, resulting in a market where few transactions occur. In the absence of an imbalance in supply and demand, home prices remain relatively stable.

WHAT DOES THIS MEAN FOR YOU?

If you’re a homeowner:

If you own a home and you’re not looking to move, ride the wave. You likely have substantial equity and a low interest mortgage that is manageable. The great news is that your equity losses from May 2022 - December 2022 are rebounding as we move through this year and it is unlikely that you will see substantial equity losses in the near future. If you’re considering moving in the next few years, let’s talk about your ideas. If you’re considering remodeling or tapping into your equity, give me a call for lender referrals that can help you access the lowest rates available right now.

If you’re a hopeful homebuyer:

If you’re newly in the market or revisiting buying a home after choosing to wait the market out for a while last year, we should talk sooner rather than later. Buyers have more power in the real estate market right now than they have in the last few years with sellers more willing to make concessions including rate buydowns, repairs and price reductions. Keep in mind, though, inventory is still low so there is still more limited selection and the best homes still sell at breakneck speeds. When you lock your rate for a home loan is very important right now as rates can change quickly and changes of even .5% can save you thousands of dollars per year in interest costs. If you love a home, you need to take steps to secure it quickly.

If you’re a potential home seller:

If you’re interested in selling your home, it’s a great time to sell. If you felt like you missed your peak price last Spring, you're well on your way to recovering from that loss. Your home has earned you substantial wealth over the last three years. The key to selling in this market is to price your home intelligently, make it as appealing to buyers as possible, market it strategically and come to the table ready to create a win-win scenario for both you and your buyer. This is my expertise and I’m never too busy for you or your referrals whether you’re considering selling or you just have questions about the market.

Most importantly, if you have questions or concerns about your specific situation… CALL ME to help sort through them. That’s why we get up in the morning - not just to sell homes, but to serve our clients.

As always, we will be here to continue to provide you with updates about the housing market and answer any and all of your questions. Feel free to reach out to us anytime.

HOMEOWNER RESOURCES:

FUTURE HOME BUYER RESOURCES:

Say Hello

Get in Touch With Us

301 Santa Fe Drive Ste B, Encinitas, CA, 92024